Moving an Admired Brand Forward

Opportunity

For many years, SouthState Bank had enjoyed a strong presence as a community bank. Through their own organic growth and acquisitions, SouthState was quickly becoming a regional brand . And with that evolution came the need for a digital transformation.

Approach

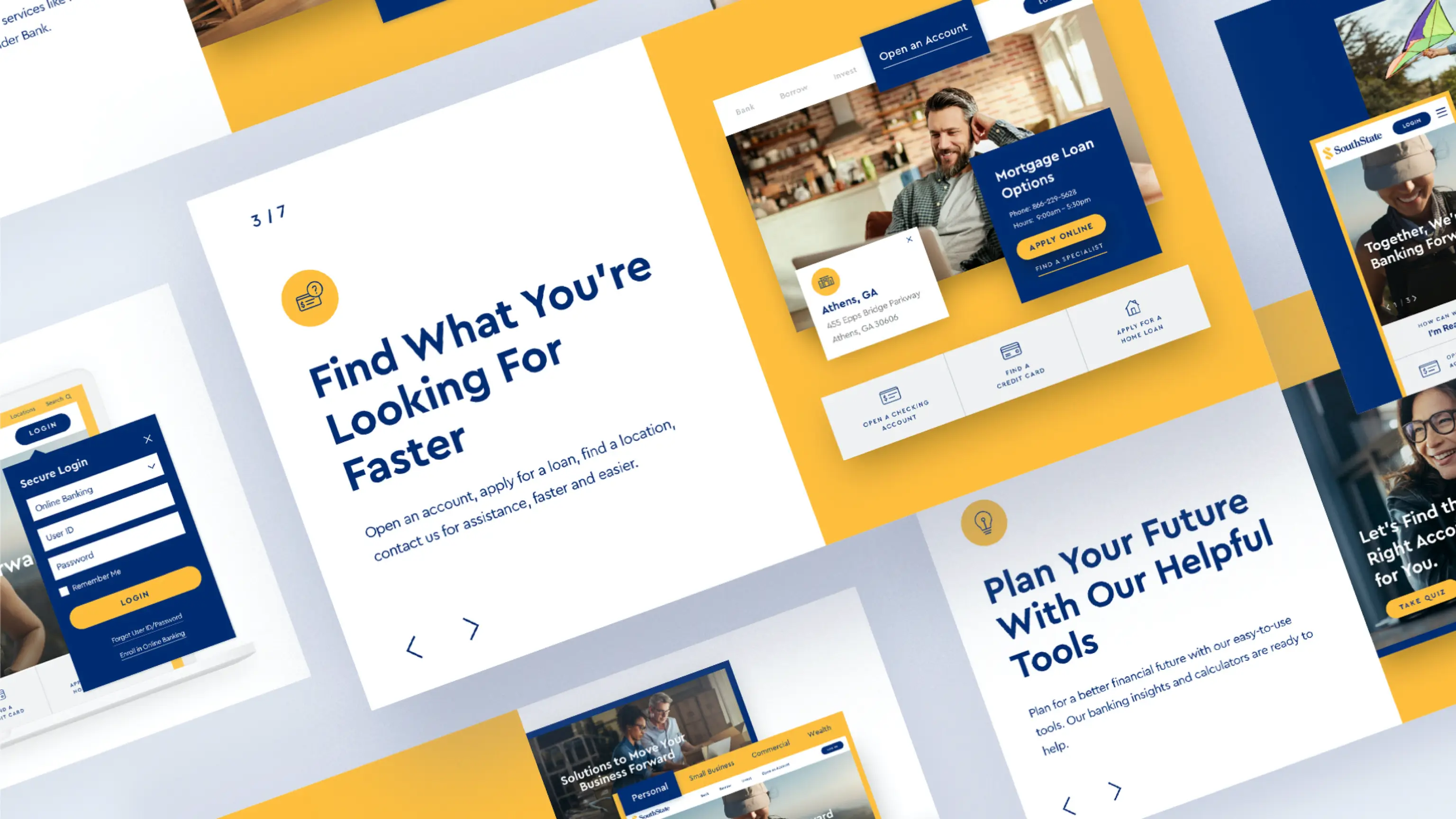

Sagepath Reply developed a strategic roadmap that laid out the specific goals for SouthState starting with an enterprise-class CMS and branding refresh.

The Start

The team chose Kentico as the CMS for its ease of integration and long-term scalability. The new site was more customer-driven and optimized for a mobile experience.

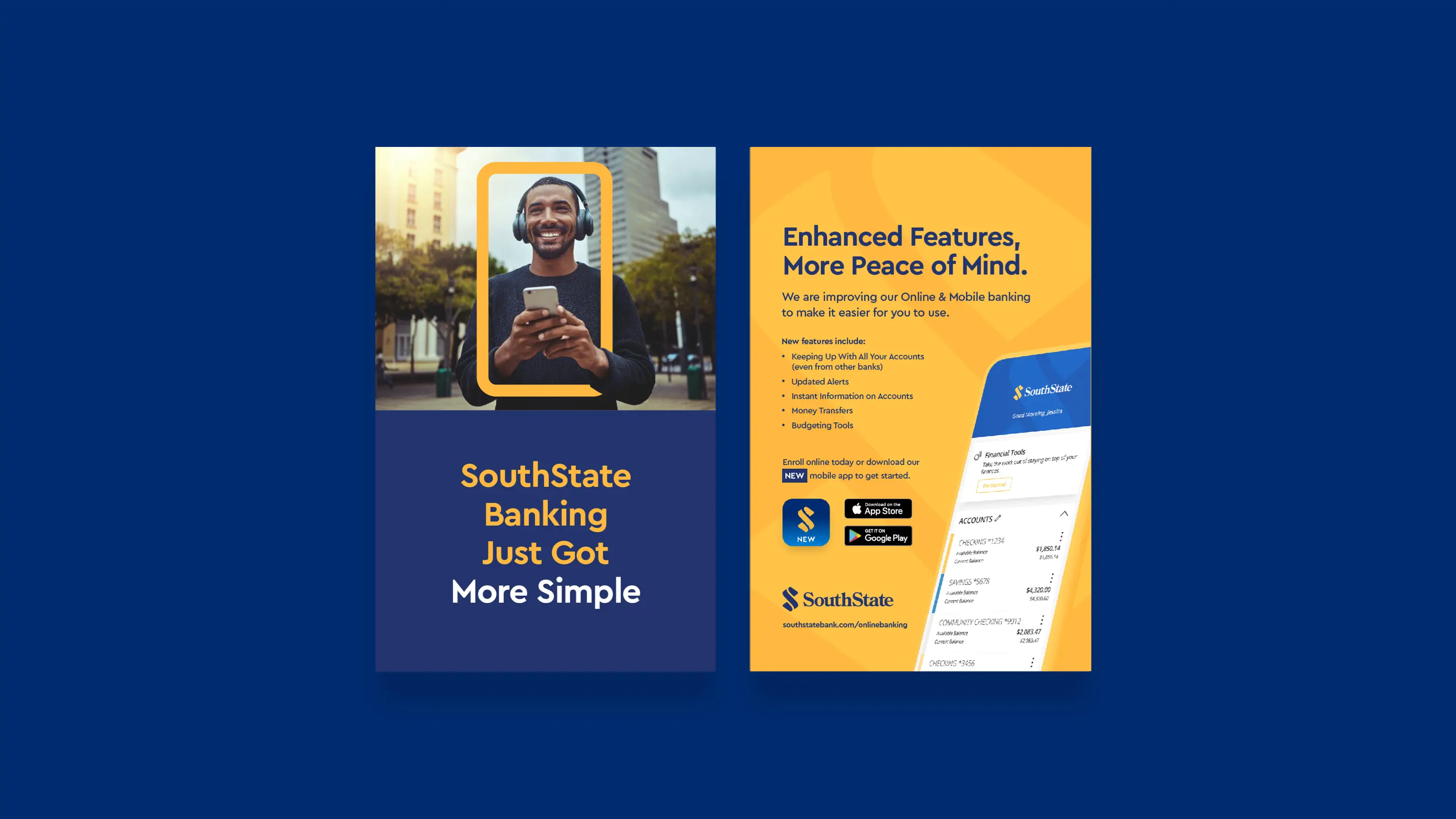

Reaching New Customers in a Challenging Environment

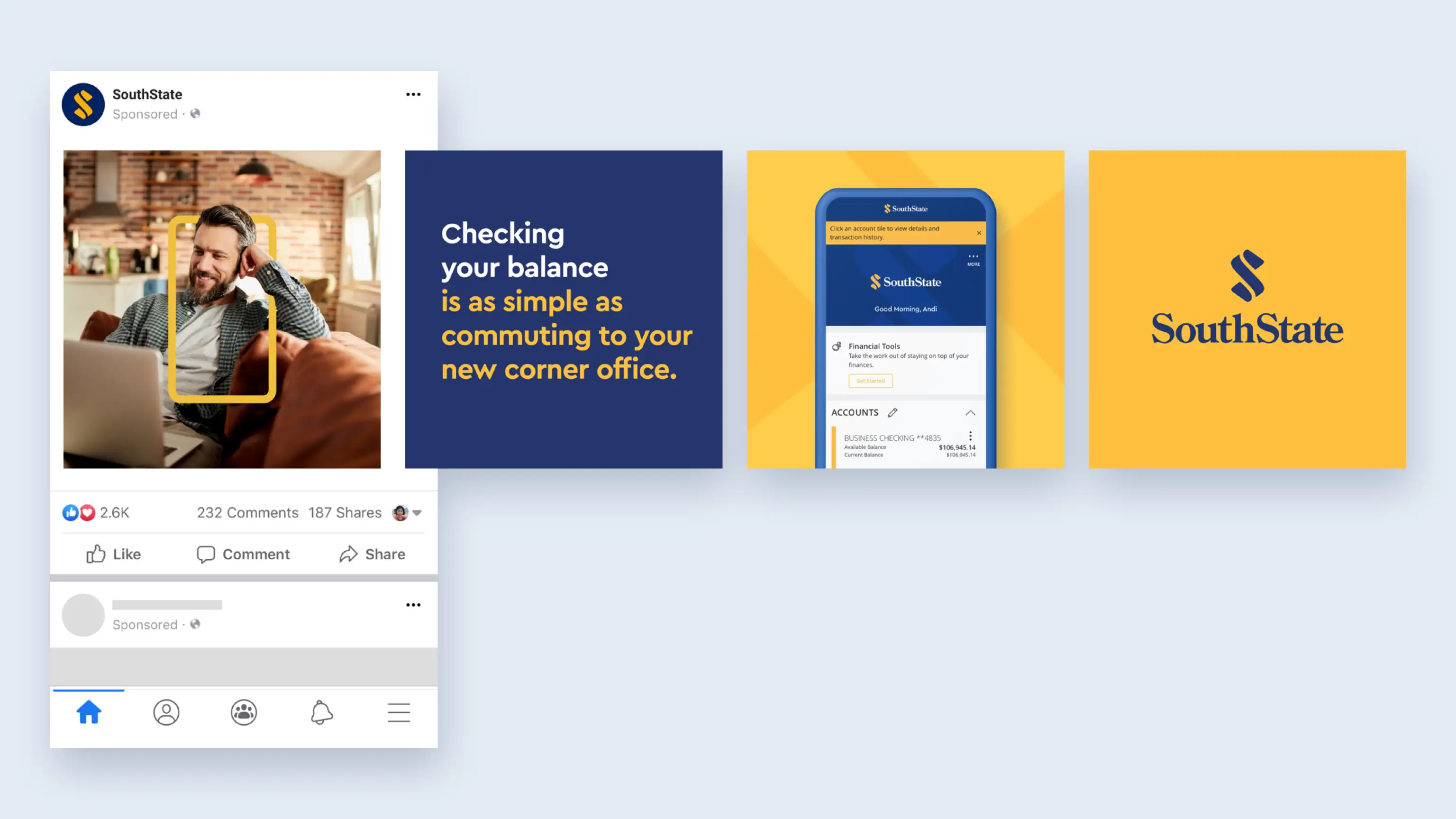

The launch of the new website coincided with a large merger for SouthState along with a global pandemic. Plans were already in place to shift a majority of SouthState’s advertising to digital first approach. Bringing in new customers and growing their loan business would be no easy feat.

Finding Efficiency and Flexibility

With many unknowns facing the team, we created a media plan for SouthState Bank that allowed for flexibility routed in data, allowing the bank to have a full funnel marketing strategy that would reach their goals of driving online acquisition for Checking, Mortgage, and Consumer Loans.

Hyper-Targeted Digital

We did fewer things and did them well, which is important when marketing budgets are limited. With the end goal in mind, we developed a comprehensive media plan that included programmatic advertising, paid social, and paid search to increase awareness, drive consideration, and ultimately convert prospects into customers.

Test, Measure, Adjust, Repeat

When our paid media team is spending real dollars to drive users to the website, it’s important to make sure the website is setup to track the ROI appropriately. This was no exception for our analytics team and SouthState. Whether it’s placing pixels, tracking conversions, standardizing UTM’s, analyzing ad groups, or visualizing return on ad spend - our analytics team has you covered.

Measuring Awareness Across the Board

For our brand campaign, we deployed a digital survey that allowed us to measure awareness from those who were and were not exposed to our ads, showing that seeing an ad does influence not only a person’s awareness of your brand, but also their sentiment toward your brand.

We leveraged promoted content to drive traffic to the website, educate consumers, as well as fill our retargeting pools for product promotion. This full funnel approach allowed us to cast a wide enough net to get in front of new consumers, while ultimately converting those prospects into customers.

A leaner, cleaner digital approach that is seeing clear growth.

for new checking account revenue.

for mortgage loan lifetime value.

from customers throughout the Southeast.

How can we transform your business?

Let’s Start a Conversation

Reach out to discuss your digital transformation needs and see how we can help. We would love to start a long-term partnership with your company.

Get in Touch